Mallorca Property Market

This page offers a concise guide to the property market in Mallorca, covering the following sections:

- Market Segmentation by Price

- Mallorca's Coastal Premium

- Property Price Trends

- Rental Returns for Property in Mallorca

- Key Areas for Luxury Property in Mallorca

- Strength in the Face of Global Crisis

- How Will US Tariffs Affect Prices?

- Looking Ahead: 2025 and Beyond

- Property Ownership in Mallorca, Freehold Structure

The island of Mallorca dominates the Balearic property market, accounting for around 80% of its transactions. Real estate in the region has been particularly resilient in recent years, characterised by a limited supply and an enduring high level of demand, especially in the luxury segment. For international buyers, the Balearic Islands, with Mallorca property leading the way, remain a secure and lucrative choice for investments, promising not only substantial returns but also a remarkably high quality of life.

Mallorca’s unique blend of an authentic Mediterranean lifestyle, stunning scenery, excellent island amenities and facilities, plus great air connectivity, has consolidated its position as a leading destination for international property investment.

Market Segmentation by Price

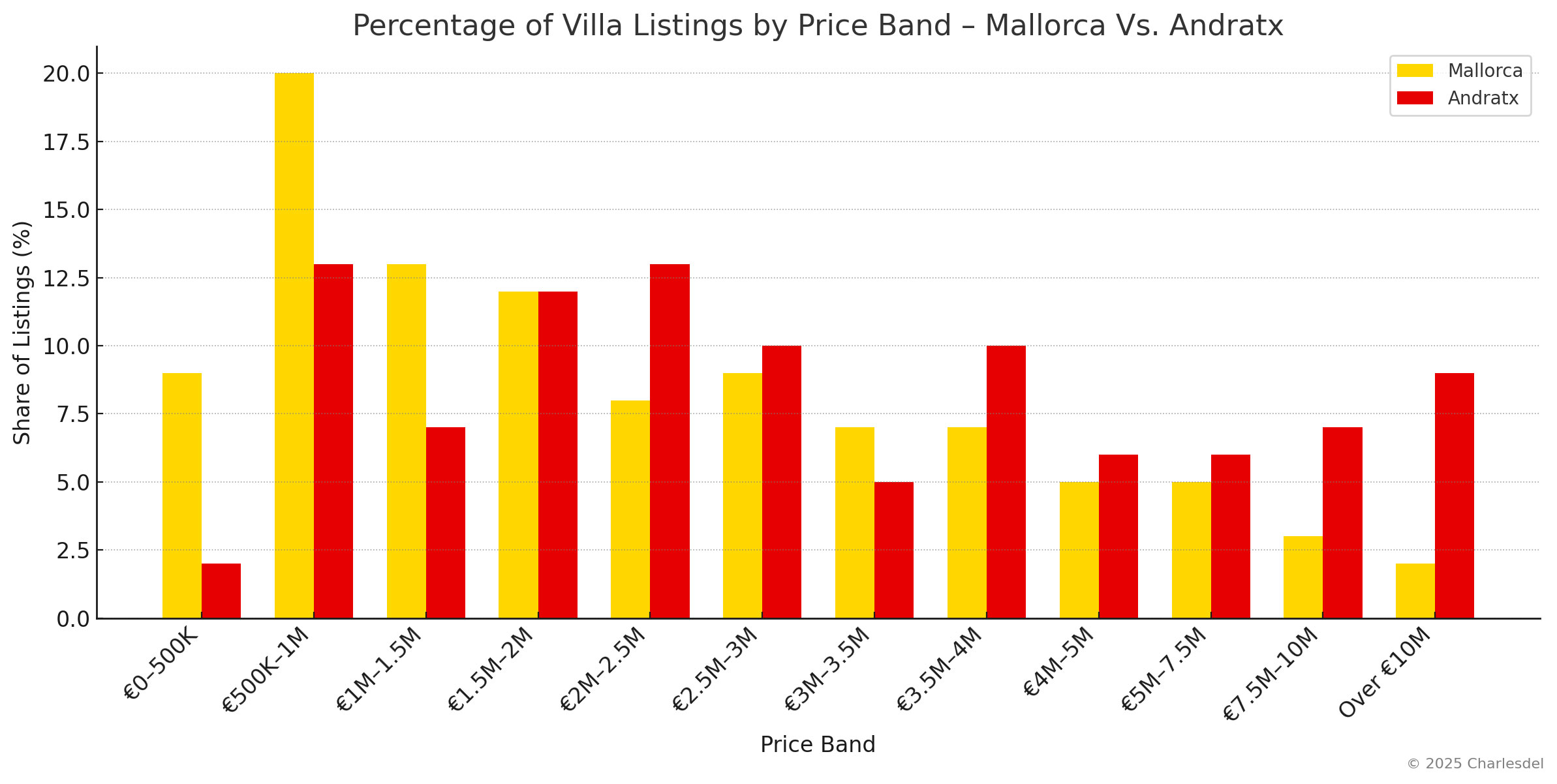

Mallorca’s real estate market has a reputation for being predominantly luxury, but the actual price distribution is more varied. We conducted our own research on 13 June 2025, analysing over 14,000 listings on Kyero. The most common price band for villas is €500,000 to €1 million, and more than half of all villa listings are priced under €2 million. However, we must note the strong luxury bias: 71% of villas in Mallorca are priced above €1 million, nearly 30% are listed above €3 million, and 10% are priced over €5 million. To put this into perspective, only around 9% of homes in London are currently valued above £1 million (source: Savills, February 2025). This reflects a strong concentration in the upper tiers, yet the island still remains accessible to a wide range of mid- and upper-tier international buyers.

This distribution is significantly more concentrated in the luxury price points when looking at Andratx, Mallorca’s most expensive municipality. Here, 85% of villas are priced above €1 million and 43% exceed €3 million. At the very top end, 17% of villas are priced over €7.5 million compared to just 5% across Mallorca. In the super-luxury segment, 9% of Andratx villas are listed above €10 million – more than four times the island-wide figure of 2%.

Mallorca and Andratx: Percentage of Villas Listed Above Each Price Point

| Over €1M: • Mallorca: 71% • Andratx: 85% |

Over €2M: • Mallorca: 46% • Andratx: 65% |

Over €3M: • Mallorca: 29% • Andratx: 43% |

| Over €5M: • Mallorca: 10% • Andratx: 23% |

Over €7.5M: • Mallorca: 5% • Andratx: 17% |

Over €10M: • Mallorca: 2% • Andratx: 9% |

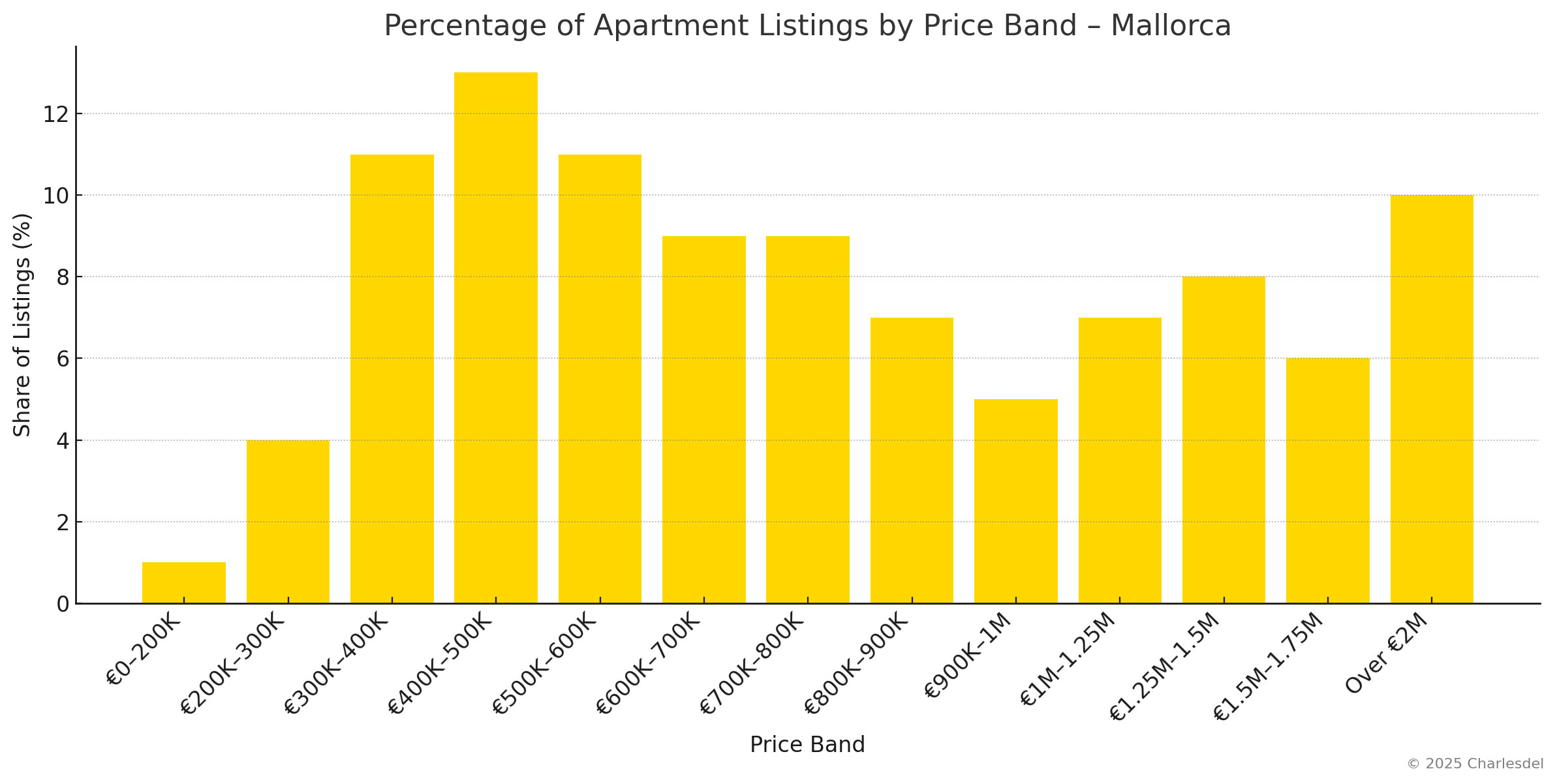

Apartments in Mallorca follow a different pattern. The most common price band is €400,000 to €500,000, and roughly half of all apartment listings are priced below €700,000. More than 50% of apartment listings fall between €300,000 and €800,000.

Mallorca Apartments: Percentage of Listings Above Each Price Point

| Over €500K: • Mallorca: 72% |

Over €1M: • Mallorca: 31% |

Over €1.5M: • Mallorca: 16% |

| Over €2M: • Mallorca: 10% |

Over €2.5M: • Mallorca: 6% |

Over €3M: • Mallorca: 3% |

Around one third are priced from €1 million upward, 16% over €1.5 million, while only 10% of apartments exceed €2 million.

Source: Kyero, June 2025

The key takeaway when looking at the price distribution of both property types - villas/houses and apartments - is that while both groups include a surprisingly high percentage of listings in more affordable price brackets, the share of listings at the luxury end of the spectrum is much more pronounced for villas and houses. This is, of course, understandable, as detached properties offer far greater design flexibility, lend themselves to extended layouts, and are better suited to maximising the Mediterranean lifestyle.

For a full breakdown by price band and property type, see our new article on Mallorca property prices and supply in 2025.

Note: detailed price segmentation tables for villas and apartments are included in the appendix.

Mallorca's Coastal Premium

Proximity to the coast remains a defining price driver across Mallorca. Based on Charlesdel Research conducted in June 2025 across 39 locations, coastal areas consistently command a significant premium, both within individual municipalities and across the island as a whole.

- Within intra-municipality comparisons, the premium for coastal zones typically ranged from 17% to 50%

- Across the island, areas with coastline averaged 40% higher prices than those without

- Fully coastal municipalities recorded 37% higher prices than fully inland ones

For a detailed breakdown by area, see our full report on Mallorca Property Prices and the Coastal Premium.

Property Price Trends

As the market for Mallorca accounts for around 80% of the total market of the Balearics, we can get a very good indication of price trends in Mallorca by looking at data for the Balearics as a whole. So, the figures quoted below for price levels in Mallorca use the regional figure as a proxy.

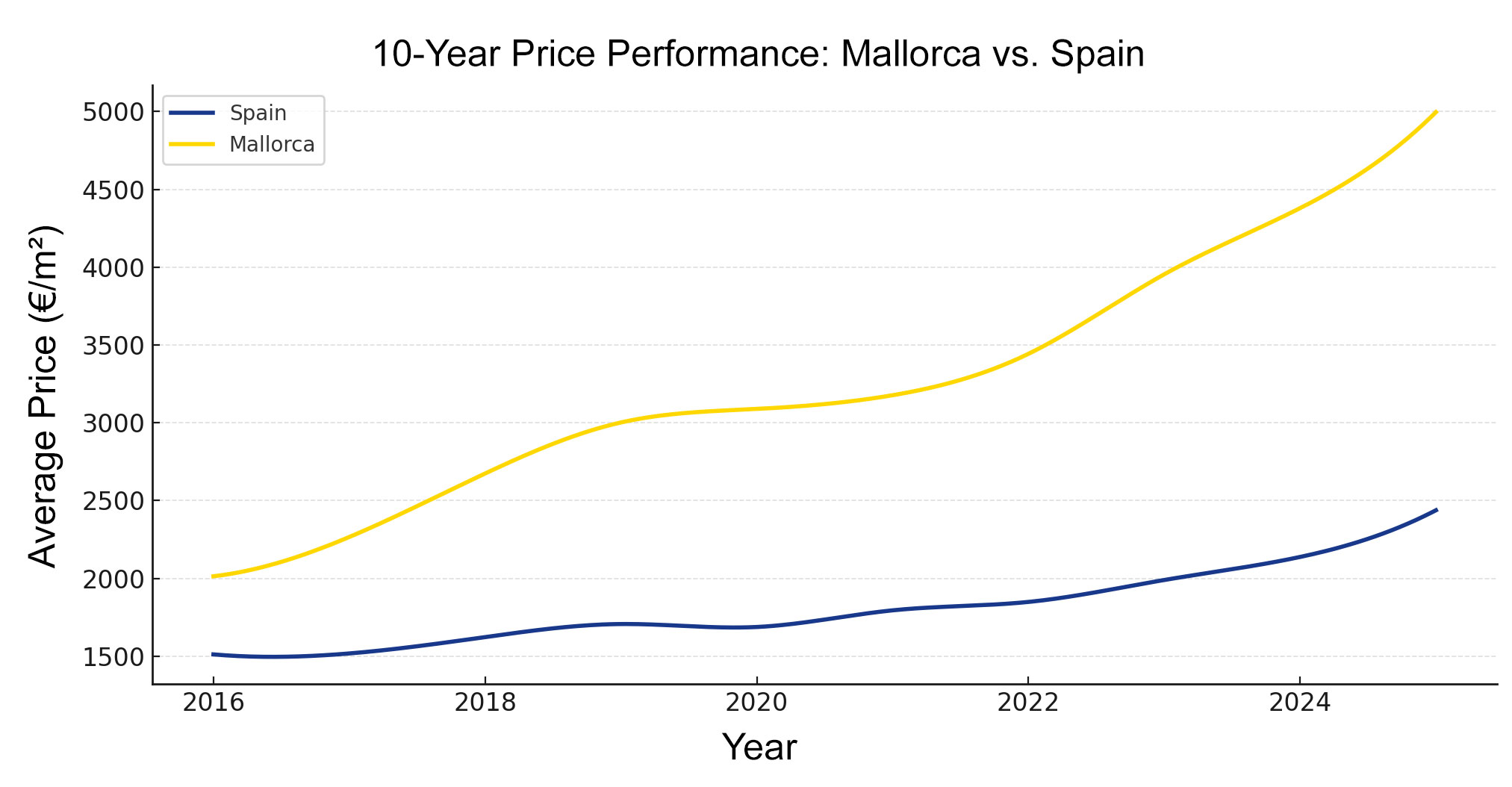

Mallorca’s 10-Year Price Growth Compared to Spain

The Mallorca property market has consistently outperformed most areas in Spain for many years and continues to do so today. Based on Idealista price data, average prices in Mallorca rose by 148% over the 10-year period from June 2016 to June 2025 - from €2,014 to €4,996 per square metre. This corresponds to a compound annual growth rate (CAGR) of approximately 9.6%. In comparison, average property prices across Spain increased by 61% over the same period - from €1,512 to €2,438 per square metre - with a CAGR of roughly 5.4%.

| Month | Spain (€/m²) | Mallorca (€/m²) |

|---|---|---|

| Jun-25 | 2,438 €/m² | 4,996 €/m² |

| Jun-24 | 2,138 €/m² | 4,379 €/m² |

| Jun-23 | 1,990 €/m² | 3,954 €/m² |

| Jun-22 | 1,849 €/m² | 3,443 €/m² |

| Jun-21 | 1,795 €/m² | 3,177 €/m² |

| Jun-20 | 1,688 €/m² | 3,089 €/m² |

| Jun-19 | 1,707 €/m² | 3,002 €/m² |

| Jun-18 | 1,623 €/m² | 2,674 €/m² |

| Jun-17 | 1,518 €/m² | 2,266 €/m² |

| Jun-16 | 1,512 €/m² | 2,014 €/m² |

Between 2021 and 2023, the key post-COVID recovery period, average property prices in Mallorca rose by 24.5%, compared to just 10.9% across Spain as a whole. This is the most recent example of the resilience of the Mallorca property market and its ability to rebound quickly from major global shocks.

Summary of Property Prices in the Balearic Islands – As of end June 2025

As of end June 2025, source Idealista, the property prices in the Balearic Islands stand at 4,996 euros per square meter. Below are the annual price changes for each month for rolling 12-month period within a 12-month timeframe:

| Month | Price per m² | Annual Variation |

|---|---|---|

| June 2025 | 4,996 €/m² | +14.1% |

| May 2025 | 4,905 €/m² | +13.5% |

| April 2025 | 4,836 €/m² | +13.7% |

| March 2025 | 4,797 €/m² | +13.9% |

| February 2025 | 4,789 €/m² | +14.3% |

| January 2025 | 4,729 €/m² | +14.0% |

| December 2024 | 4,707 €/m² | +15.3% |

| November 2024 | 4,686 €/m² | +15.7% |

| October 2024 | 4,663 €/m² | +14.8% |

| September 2024 | 4,561 €/m² | +13.1% |

| August 2024 | 4,512 €/m² | +13.2% |

| July 2024 | 4,445 €/m² | +11.9% |

These figures indicate consistently high price increases for each 12-month period, ranging from 11.9 to 15.7%, reflecting the high demand and limited supply throughout the Balearics. This impressive growth in property prices underscores the regions' continued appeal as a prime location for real estate investment, particularly in the luxury segment.

* Note: Idealista uses a monthly estimate of the average residential prices based on live property listings on their platform. This reflects the current offer prices as opposed to the property sales price, but it serves as a valuable market indicator for price levels and trends.

Rental Returns for Property in Mallorca

Over the past 10 years, long-term rental rates in the Balearic Islands have risen sharply. In May 2016, the average asking rent stood at €10.4 per square metre per month. As of June 2025, that figure has increased to €20.2/m²/month, representing a +94% increase across the decade.

By comparison, sales prices rose even faster, from €2,003/m² in 2016 to around €4,996/m² today, an increase of nearly +150%. This dynamic has compressed gross rental yields in Mallorca, which have declined from approximately 6.2% in 2016 to around 4.85% in 2025.

Still, a gross yield of 4.85% is highly competitive and similar to levels achievable in established urban rental markets such as London. According to Zoopla, the average gross rental yield for London properties stood at approximately 4.3% in early 2025. For investors focused on long-term rental property in Mallorca, the island offers stable income potential and relatively low management costs, particularly in demand areas such as Palma and its surrounding suburbs.

However, the strongest rental returns in Mallorca are typically found in the licensed short-term holiday rental segment, which is more closely aligned with the island’s positioning as a high-end lifestyle and second-home destination. In prime coastal areas, short-term holiday lets in villas or upscale apartments can achieve net rental yields in the range of 5% to 8%, as commonly quoted by established local rental companies, typically exceeding what’s achievable through long-term tenancy models.

Note: All short-term holiday rentals in Mallorca require a valid ETV (Estancia Turísticas en Viviendas) licence. New licences are not currently being issued in most areas, but existing ones are transferable to new owners. These licences certify that the property meets the legal standards for tourist accommodation.

Key Areas for Luxury Property in Mallorca

To highlight the key areas in Mallorca for luxury property, this section focuses on the island’s four most expensive municipalities by average price per square metre - Andratx (€7,503), Calvià (€6,844), Puigpunyent (€5,413), and Palma de Mallorca (€4,907) - based on Idealista data as of end-June 2025. We also include Pollença, where the coastal enclave of Puerto de Pollença commands an average of €5,432/m², placing it among the most valuable locations in the north.

One key point to note is that all of these municipalities include coastline - a major driver of price and luxury positioning - except Puigpunyent. Despite being entirely inland, Puigpunyent still ranks as the third most expensive municipality in Mallorca. As we explain below, this is due to its proximity to both the desirable southwest coast and the capital, Palma de Mallorca.

Another key insight is that the percentage of properties priced at luxury levels is significantly higher when looking at villas and houses, as opposed to apartments. In other words, the differential compared to the island-wide average is far more noticeable in the villa and house segment.

Note: for quoted price segmentation figures in the sections below, we have used our own analysis of live listings on Kyero as of end-July 2025.

Andratx

Andratx is the most expensive sub-market on Mallorca, and it is no coincidence that two-thirds of the municipality’s borders are coastline. Within Andratx, proximity to the sea drives prices even higher. Our in-house research from July 2025 shows that Port d’Andratx commands a 17% premium over the municipal average.

The average listing price for villas and houses in Andratx is €3,878,086, which is approximately 44.5% higher than the equivalent figure for Mallorca. For apartments, the average price is €1,120,360 - only 9.1% higher than the island-wide average of €1,026,957. This clearly shows that Andratx’s luxury status is primarily driven by pricing in the villa and house segment.

Calvià

Calvià, which includes premium areas like Bendinat, Costa d’en Blanes and Calvià town, is the second most expensive municipality in Mallorca, with an average asking price of €6,844/m² as of June 2025 (Idealista). The market here is defined by Mediterranean villas, fincas, and organic-modern builds, often with sea or mountain views. Limited supply, high international demand, and strong long-term fundamentals make Calvià one of the most resilient and desirable locations on the island.

Calculated using weighted figures from 977 live listings as of July 21st 2025, the average listing price across villas and houses in Calvià is €3,664,617, around 37% higher than the Mallorca-wide average of €2,684,381. For apartments, the average stands at €1,174,903, which is approximately 14% above the island average of €1,026,957.

See our full Calvià property data and pricing breakdown here.

Puigpunyent

Puigpunyent stands out as a rare inland exception, with an average price of €5,413/m², making it the third most expensive municipality on the island - behind only Andratx and Calvià, whose prices are driven up by their coastal premiums.

Its appeal lies in a unique combination of privacy, landscape, and location. Set within the Tramuntana Mountains, Puigpunyent offers dramatic views and generous plots well-suited to luxury rural estates. It also benefits from close proximity to Palma and easy access to the southwest coast. The municipality directly borders both Andratx and Calvià, and as land supply tightens in those neighbouring markets, new development interest is increasingly spilling into Puigpunyent.

Palma

Home to the island’s capital, the municipality of Palma de Mallorca accounts for around one fifth of all property listings on the island. The average villa listing in Palma is priced at €3.4 million, approximately 26.7% above the island-wide average of €2.7 million. For apartments, the average is €1.26 million, which is 22% higher than the Mallorca average of €1.03 million.

On a price-per-square-metre basis, Palma stands at €4,907. This is heavily influenced by premium coastal neighbourhoods such as Portixol–Molinar priced at €7,371/m².

In contrast, inland places such as Son Oliva (€3,460/m²) and Rafal (€3,251/m²) are significantly below the municipal average and more appealing to the local market. However, there are several inland exceptions that command some of the island’s highest prices, including Son Vida (€8,633/m²) and the enclave of Genova–Bonanova–Sant Agustí (€6,318/m²), source Idealista July 2025.

For a detailed breakdown of Palma’s micromarkets, including price distributions and area-by-area analysis, read our latest article: Palma, Mallorca – What Defines the Property Market

Puerto de Pollensa

The average listing price for villas in Puerto de Pollensa is €2.4 million, which is lower than the Mallorca-wide average of €2.7 million. Similarly, apartments have an average price of €900,000, slightly lower than the island-wide average of €1 million.

However, on a price-per-square-metre basis, Idealista data from end July 2025 shows Puerto de Pollensa at €5,432/m², higher than the figure for the region as a whole (€4,996), which includes the more expensive island of Ibiza. This divergence between average price and €/m² is explained by more compact build sizes in the area, which push up the price per square metre despite lower overall listing values.

Strength in the Face of Global Crisis

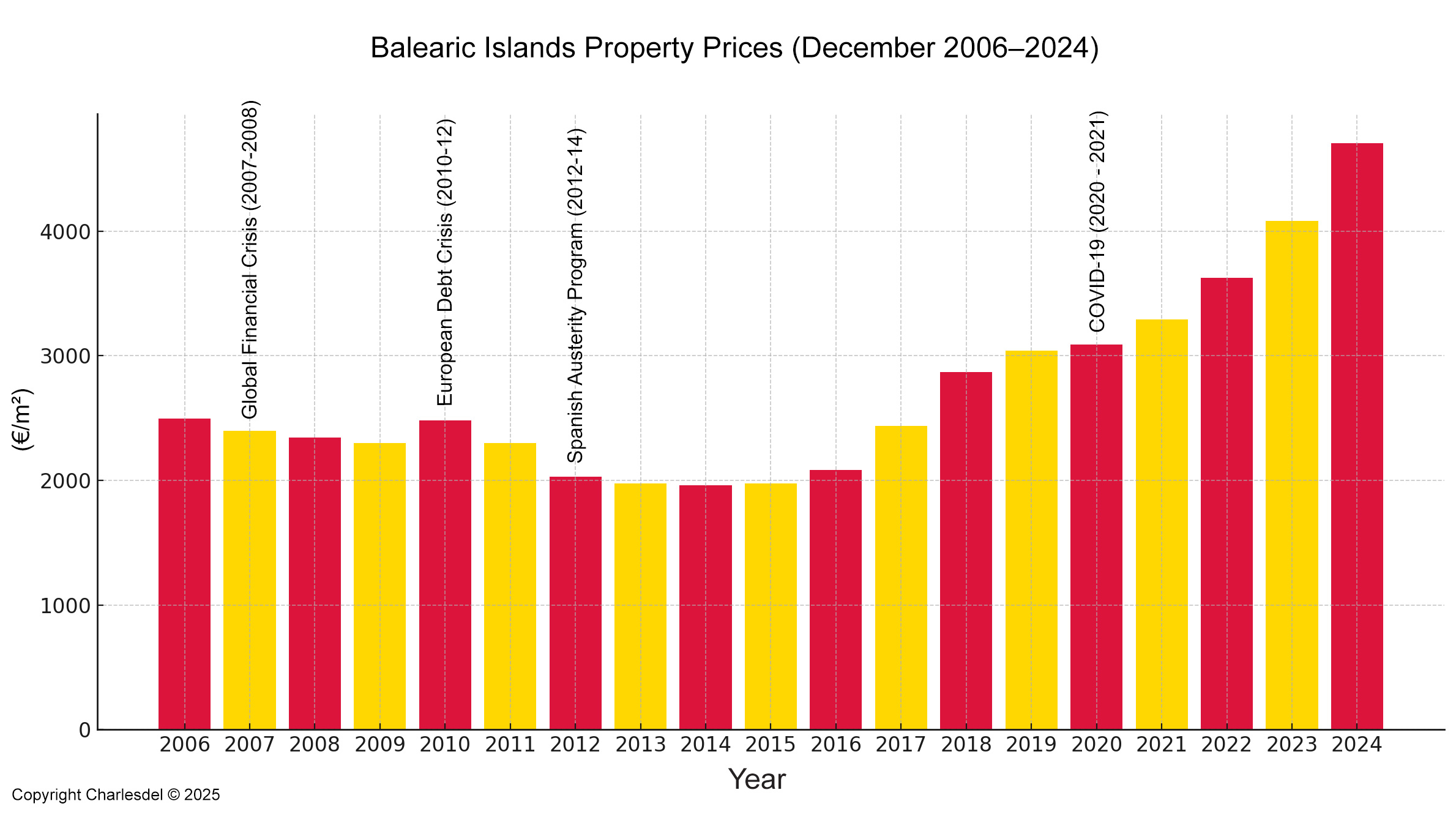

The chart below shows how property prices in the Balearic Islands – dominated by Mallorca, accounting for around ¾ of property transactions – performed from 2006 to 2024 in response to the most significant global economic crises during this period.

From 2007 to 2024, Mallorca's property market was tested by five major global economic crises. The bar chart reflects how each event influenced pricing trends, revealing both short-term impacts and longer-term resilience.

The Global Financial Crisis in 2007–2008 triggered the initial downturn, with prices in Mallorca falling during both years. However, compared to other real estate markets, the decline was more moderate. A strong international buyer base, especially in the luxury segment, and high levels of cash transactions limited the damage. By 2009, the chart shows that recovery was already underway.

The European Debt Crisis from 2010 to 2012 brought renewed pressure, as Spain’s economy struggled with high unemployment and growing fiscal instability. Property prices in Mallorca fell further during this period, though the drop was most pronounced in inland or oversupplied areas. The island’s prime locations held up best, supported by continued foreign demand and a healthy tourism sector.

During the Spanish Austerity Program (2012–2014), the national property market continued to deteriorate, dragged down by tight credit conditions and weak domestic confidence. In contrast, Mallorca’s prices stabilised, forming a plateau. The island’s strict planning rules, limited overdevelopment, and continued appeal to cash-rich international buyers helped prevent further decline.

The COVID-19 pandemic in 2020 caused severe disruption to travel and in-person transactions, but prices in Mallorca did not fall. Instead, they remained stable through the lockdown period and rose steadily from late 2020 through 2021. This reflects both constrained supply and the perception of Mallorca as a secure, high-quality destination for lifestyle and investment.

In 2022, the Ukraine war and resulting inflation shock placed new pressure on European property markets. Rising interest rates impacted mortgage-reliant buyers across the continent. Yet Mallorca again diverged: prices continued to climb, with a 12% increase recorded from December 2022 to December 2023. Limited supply, sustained international demand, and low reliance on borrowing helped the market to once again post record prices.

The chart above is testament to the ability of Mallorca’s property market to withstand and recover from the world’s most significant economic shocks over the past two decades. The robustness of its market is due to several inherent characteristics.

A high proportion of high-net-worth individuals, second home and lifestyle buyers, and long-term investors play a central role. This group brings two key advantages: a lower reliance on financing, with many purchases completed in cash, and a greater ability to absorb economic shocks without being forced to sell.

Tourism-led demand – sustained by a strong year-round tourism sector – feeds the market. Strict planning and zoning restrictions help to limit supply and support long-term pricing stability. All of this is underpinned by Mallorca’s world-renowned status as a luxury holiday and investment destination – in effect, the brand of Mallorca.

See our guest post on PropertyWire about the Mallorca property market, covering 18 years of performance and resilience.

How Will US Tariffs Affect Prices?

The 90-day suspension of U.S. tariffs announced on April 9, 2025, expired on July 8, and the measures have now formally taken effect. While the direct effect of U.S. tourists on the Mallorca property market is likely to be limited - accounting for just 4.2% of transactions in 2023, according to a report by the Majorca Daily Bulletin - the wider economic context, including heightened market volatility and downgraded European GDP forecasts, continues to shape sentiment across Mallorca’s key buyer groups. For a deeper analysis of how the new U.S. tariffs could affect demand and pricing in Mallorca’s real estate market.

For a deeper analysis of how the new U.S. tariffs could affect demand and pricing in Mallorca’s real estate market: Read our full article on US Tariffs and Mallorca Property

Looking Ahead: 2025 and Beyond

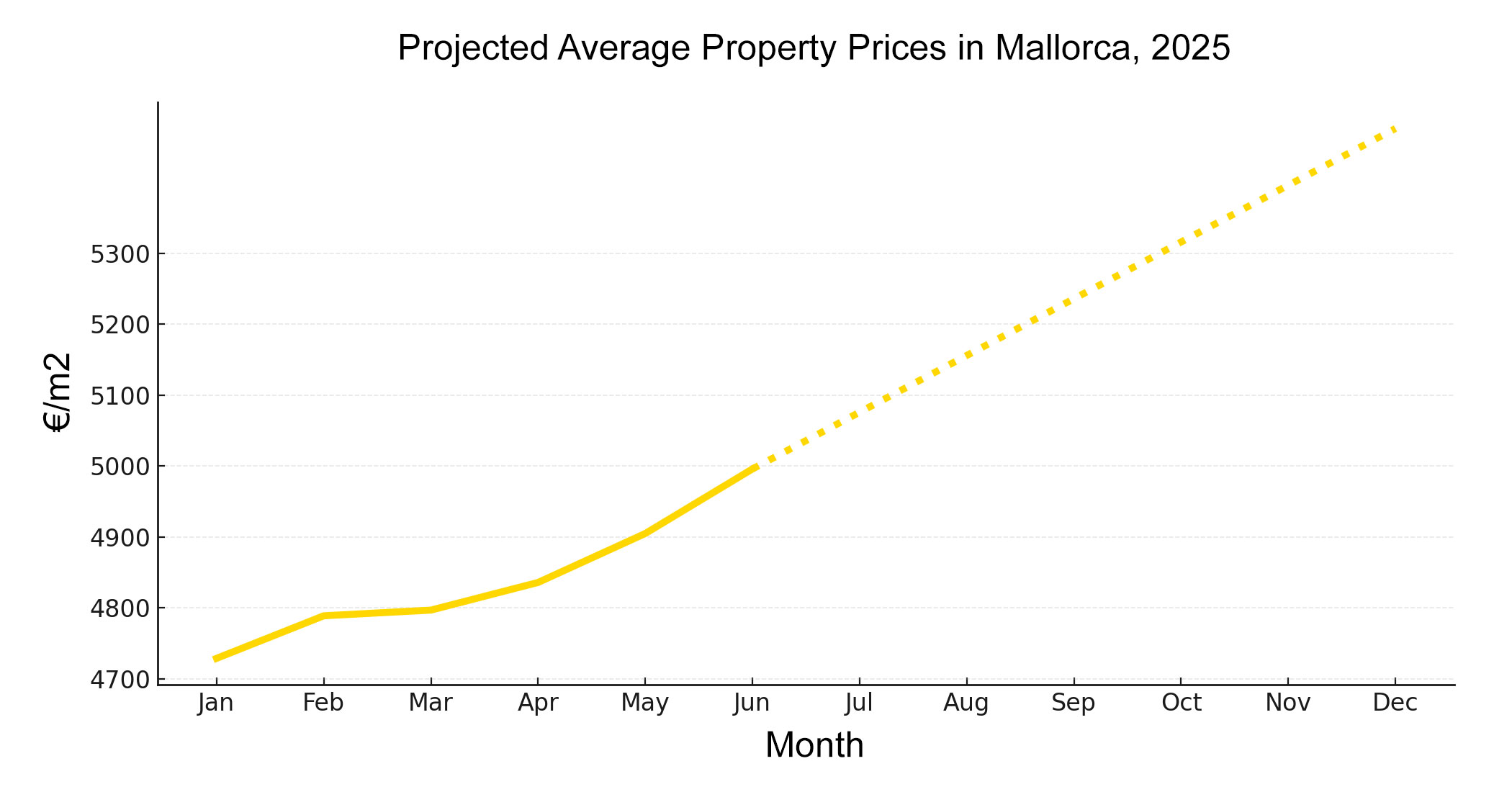

One way to assess how the market may perform in the second half of 2025 is to examine the price trend for the first six months and extend that trajectory forward. As shown in the graph below, the rate of price growth has been relatively consistent, with average values increasing by 5.65% between January and June. Barring any unforeseen events that significantly alter market conditions, it is reasonable to project a similar pace of growth for the remainder of the year.

At the start of 2025, established agents on the island were generally quoting price growth forecasts in the range of 5% to 8% for the year as a whole. Midway through the year, those projections appear broadly on track, with market data now supporting the view that Mallorca could close the year toward the upper end of that range, provided current conditions hold steady.

While the property market has remained undoubtedly strong during the first half of 2025, we do need to acknowledge the significant slowdown in tourist numbers - as reported by The Independent on 28 July 2025 - largely attributed to protests over overtourism and rising property prices pricing locals out of the market.

However, overall tourist numbers this year remain high, and the strength of the Mallorca brand is likely to continue attracting robust visitor demand in the medium term.

It’s also important to note that even when tourism does experience a material drop, the effect on property prices is rarely immediate. There is typically a time lag. Most international buyers visit the island at least once before committing, and the process from initial visit to completed purchase can stretch over many months. In the short term, pricing is shaped more directly by buyers already further along the decision chain.

Property Ownership in Mallorca – Freehold Structure

From an investment standpoint one of the key advantages of buying property in Mallorca is the clarity and permanence of ownership. Unlike in the United Kingdom where apartments are typically sold on leases with diminishing terms and ground rent obligations, residential properties in Spain including apartments are sold freehold, giving buyers long-term security and full legal title.

In apartment buildings and residential developments with shared elements, ownership is governed by Spain’s Horizontal Property Law (Ley de Propiedad Horizontal). This means you own your private unit outright and also hold a proportional share of any communal areas such as land, gardens or hallways.

This structure applies not only to apartments but also to villa developments and urbanisations with shared amenities. Leasehold sales are extremely rare in Spain, and where they do exist they are typically used for long-term rental agreements with terms commonly running for five years. Unless clearly stated otherwise, properties advertised to overseas buyers are sold freehold.

For more legal detail see our Property Ownership in Spain FAQ.

Appendix: Detailed Pricing Tables

Data from Charlesdel Research on 13 June 2025 using Kyero live listings.

Mallorca Villas – Price Distribution

| Price Band | Count | % of Listings |

|---|---|---|

| €0–500K | 851 | 9% |

| €500K–1M | 1986 | 20% |

| €1M–1.5M | 1280 | 13% |

| €1.5M–2M | 1214 | 12% |

| €2M–2.5M | 825 | 8% |

| €2.5M–3M | 901 | 9% |

| €3M–3.5M | 641 | 7% |

| €3.5M–4M | 659 | 7% |

| €4M–5M | 518 | 5% |

| €5M–7.5M | 495 | 5% |

| €7.5M–10M | 282 | 3% |

| Over €10M | 204 | 2% |

| TOTAL | 9856 | 100% |

Andratx Villas – Price Distribution

| Price Band | Count | % of Listings |

|---|---|---|

| €0–500K | 15 | 2% |

| €500K–1M | 116 | 13% |

| €1M–1.5M | 68 | 7% |

| €1.5M–2M | 113 | 12% |

| €2M–2.5M | 116 | 13% |

| €2.5M–3M | 90 | 10% |

| €3M–3.5M | 48 | 5% |

| €3.5M–4M | 90 | 10% |

| €4M–5M | 50 | 6% |

| €5M–7.5M | 57 | 6% |

| €7.5M–10M | 61 | 7% |

| Over €10M | 84 | 9% |

| TOTAL | 908 | 100% |

Mallorca Apartments – Price Distribution

| Price Band | Count | % of Listings |

|---|---|---|

| €0–200K | 43 | 1% |

| €200K–300K | 166 | 4% |

| €300K–400K | 485 | 11% |

| €400K–500K | 573 | 13% |

| €500K–600K | 500 | 11% |

| €600K–700K | 392 | 9% |

| €700K–800K | 384 | 9% |

| €800K–900K | 312 | 7% |

| €900K–1M | 218 | 5% |

| €1M–1.25M | 317 | 7% |

| €1.25M–1.5M | 348 | 8% |

| €1.5M–1.75M | 245 | 6% |

| Over €2M | 442 | 10% |

| TOTAL | 4425 | 100% |

Mallorca Property Prices by Municipality – June 2025

| Location | Price per m² (June 2025) | Annual Variation |

|---|---|---|

| Alaró | 4,181 €/m2 | 8.0% |

| Alcúdia | 4,567 €/m2 | 13.1% |

| Algaida | 3,271 €/m2 | 11.4% |

| Andratx | 7,503 €/m2 | 11.9% |

| Binissalem | 2,591 €/m2 | 8.9% |

| Bunyola | 3,372 €/m2 | 5.5% |

| Cala Millor | 2,809 €/m2 | 15.3% |

| Cala Ratjada | 3,918 €/m2 | 16.2% |

| Cala d'Or | 5,711 €/m2 | 9.2% |

| Calvià | 6,844 €/m2 | 9.4% |

| Campanet | 2,565 €/m2 | 12.5% |

| Capdepera | 3,214 €/m2 | 13.5% |

| Colonia de Sant Pere | 4,514 €/m2 | 14.7% |

| Esporles | 3,809 €/m2 | 11.3% |

| Felanitx | 2,781 €/m2 | 13.2% |

| Inca | 2,020 €/m2 | 13.8% |

| Lloseta | 1,781 €/m2 | 4.2% |

| Llubi | 2,396 €/m2 | 11.5% |

| Llucmajor | 3,188 €/m2 | 7.2% |

| Manacor | 2,437 €/m2 | 10.5% |

| Marratxi | 2,727 €/m2 | 9.0% |

| Montuiri | 2,231 €/m2 | 12.6% |

| Palma de Mallorca | 4,907 €/m2 | 18.4% |

| Pollença | 4,667 €/m2 | 10.9% |

| Porreres | 2,725 €/m2 | 11.8% |

| Porto Colom | 3,688 €/m2 | 15.5% |

| Puerto de Pollença | 4,716 €/m2 | 11.4% |

| Puigpunyent | 5,413 €/m2 | 42.1% |

| Sa Coma | 2,688 €/m2 | 11.5% |

| Sa Ràpita | 4,214 €/m2 | 19.2% |

| Sant Llorenç Des Cardassar | 2,587 €/m2 | 17.0% |

| Santanyi | 5,306 €/m2 | 4.7% |

| Santa Margalida | 2,669 €/m2 | 16.6% |

| Santa Maria del Cami | 3,764 €/m2 | 4.3% |

| Sencelles | 2,490 €/m2 | 15.1% |

| Ses Salines (Mallorca) | 4,219 €/m2 | 6.4% |

| Sineu | 2,574 €/m2 | 6.9% |

| Sóller | 5,027 €/m2 | 13.4% |

Palma de Mallorca